8-Times Greater Demand from Investors to Galata Wind, Turkey's First Green Public Offering

21.04.2021

According to the results of the book-building for the public offering of Galata Wind Enerji A.Ş. on 15-16 April 2021, a total per value stock shares of 1,1 billion TRY-worth of applications have been made for the company's public offering.

Total allocation for the company's public offering had been planned at 133,7 million TRY per value stock. Thus, the demand for the company's public offering has been 8-times greater than anticipated. The company's total public offering size has been concluded at 811 million TRY. The public offering stirred much interest from foreign investors with Goldman Sachs and Norges Bank Investment Management buying more than 5% of shares each.

The book-building process of the public offering of Galata Wind Enerji A.Ş.' shares, Turkey's first green public offering, has taken place on 15-16 April 2021 and was led by Garanti BBVA Investment. The company's 133.697.870 TRY of per value stock shares have been offered to the public. Following applications, the selling of per value stock shares of 26.739.570,00 TRY corresponding to 20% of shares offered resulted in a total selling of 160.437.440 TRY per value stock shares. According to final results, the size of the public offering has been of 811.018.951 TRY as a result of the selling of the 160.437.440 TRY per value stock shares.

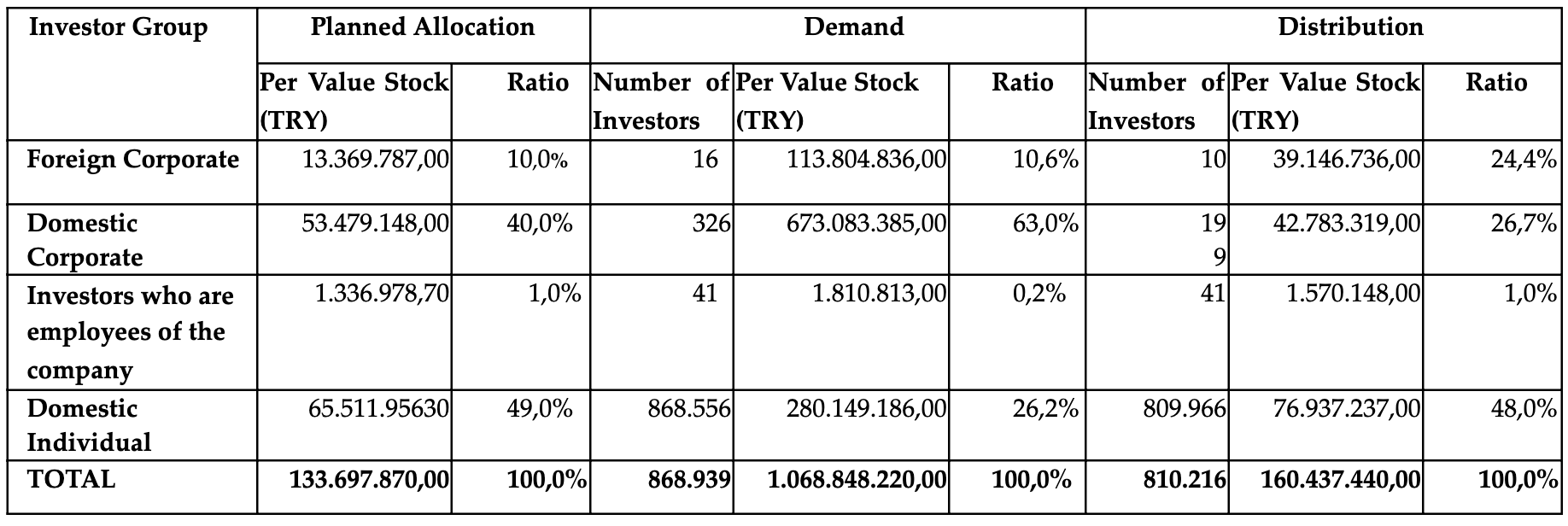

During the public offering where the price per share was fixed to 5,04 TRY, demand has been 12,6-times greater than the shares allocated to domestic corporate investors, it has been 8,5-times greater than shares allocated to foreign corporate investors, 4,3-times greater than shares allocated to domestic individual investors and 1,4-times greater than shares allocated to company employees.

Demand from foreign investors has been 8,5-times greater than allocation

13.369.787,00 TRY of per value stock shares corresponding to 10% of the 133.697.870,00 TRY per value stock shares offered to the public were allocated to foreign investors with 16 foreign corporate investors making a total demand of 39.146.736,00 TRY of per value stock shares which is 8,5-times greater than the 113.804.836,00 per value stock shares allocated to them. As a result of the distribution, a total of 39.146.736,00 TRY of per value stock shares corresponding to 198.082.484,16 TRY including the greenshoe option have been sold to foreign corporate investors, those shares representing 24,4% of the final public offering size. According to declared results, two institutions bought more than 5% each, namely Goldman Sachs acquiring 5,05% and Norges Bank Investment acquiring 6,01% of shares.

'Galata Wind will make a difference in the transitioning to carbon-neutral economy'

Doğan Group CEO Çağlar Göğüş affirmed that they are extremely delighted that the public offering of Galata Wind Enerji A.Ş., one of their group companies, has attracted 8-times greater demand than planned and stirred interest from two of the most important ESG-focused foreign investors in the world, Goldman Sachs and Norges Bank Investment Management. Thanking all domestic and foreign investors for their interest, Göğüş stated that Galata Wind Enerji -offered to the public with the motto "Turkey's first green public offering"- plays a very important role in the raising of awareness on global trends in sustainability and in the transitioning to a carbon-neutral economy in the Turkish investment ecosystem. Göğüş continued:

"I believe that the public offering of Galata Wind Enerji will contribute positively to the energy transformation process in our country. As Doğan Group, we focus on positive impacts in all of our investments by assessing innovative and value-oriented business opportunities to be created by the UN's Sustainable Development Goals and by basing ourselves on our values and on our 61-year-old past. We reduce all possible negative environmental and social impacts and approach new investments from this perspective as an organization that creates value for society and the world. I would like to extend my gratitude to all members of the consortium, particularly Garanti BBVA Investment who has led the public offering of our fully-green and renewable energy resource-based company Galata Wind, as well as all of our business partners who have shown their support to the process."

'Galata Wind's strong capital structure and potential have been reciprocated by the investor'

Galata Wind Enerji A.Ş. CEO Burak Kuyan said that Galata Wind Enerji's public offering has seen the significant reciprocation by both domestic and foreign corporate investors of the company's sustainable and eco-friendly electricity production portfolio, predictable cash flow and costs, operational efficiency, strong capital structure, growth potential, international commitments in the area of sustainability and beneficial elements of the Turkish electricity industry. Thanking investors who have shown great interest in Galata Wind Enerji, as well as Garanti BBVA and members of the consortium who have led the public offering process, Kuyan stated "As a partner of energy transformation in the world and in Turkey and of sustainability in general, we will produce renewable energy from endless resources and thus continue to contribute to the reduction of our country's dependence to foreign countries and to the 2019-2023 strategy of the Turkish Ministry of Energy and Natural Resources with the motto 'More Local More Renewable'".

'We are proud to be leading Turkey's first green public offering'

Garanti BBVA Investment CEO Utku Ergüder said "As Garanti BBVA Investment, we are proud to be leading Turkey's first green public offering with Galata Wind Enerji. In this process, we have witnessed, after a long period of time, a foreign demand that neared almost the entire size of the public offering. On the other hand, we are also happy to have been able to reach more investors by making an equal distribution to individual investors and to create the opportunity for corporate investors to take part in the public offering by allocating shares to them as well. In the period to come, we aim at taking part in other sustainability projects such as this one and at creating value for our shareholders with structures that we will once again be leading."

Footnote:

The public offering of Galata Wind Enerji A.Ş. has been brokered by a consortium of 30 members led by Garanti BBVA Investment. The allocation and distribution of shares in the public offering based on investor groups have been as follows: