Notification on Buying and Selling Non-Share Capital Markets Instrument – Doruk Faktoring

29.01.2021

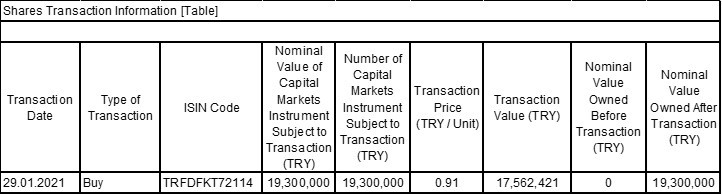

Our Board of Directors have resolved on 29.01.2021 (today);

to acquire 19,300,000 Doruk Faktoring A.Ş. Financing Bonds (ISIN Kodu: TRFDFKT72114) with a nominal value of 19,300,000 Turkish Liras in return for 17,562,421 Turkish Liras which have been issued on January 29, 2021 by Doruk Faktoring A.Ş., our direct subsidiary whereby our Company holds 99.99% shares in its fully paid capital of 60,000,000 Turkish Liras. Financing bonds, which will be issued at a discount, have a maturity of 181 days and a maturity to annual compound gross revenue rate of 20.96% in case of need, and the annual simple gross revenue rate of which is calculated as 19.95%. The sales price is 0.90997 Turkish Liras each (nominal value of 1 Turkish Liras).

The purchase price is the same with the purchase price of the 3rd parties buying in this issuance.

A separate “valuation report” has not been obtained as the transaction amount remains below the criteria set forth in section (a) of paragraph 2 of Article 9 of “”II-17.1 Corporate Governance Decree” of the Capital Markets Board (“CMB”).